ECONOMIC THEORY

Economic theory is the foundation of how we understand decision-making, resource allocation, and market behaviour. From the laws of supply and demand to debates over government intervention, these ideas shape everything from household budgets to national policy. For A-level students, theory isn’t just academic — it’s the lens through which we interpret real-world events like inflation, unemployment, and inequality.This section explores the thinkers and models that have shaped economics over time, including classical, neoclassical, and Keynesian perspectives. By linking these theories to historical milestones and today’s challenges, you'll build a deeper understanding of how economic ideas evolve — and how they continue to influence the world around us.

Classical Economics

The origins of market thinking

Classical economics was the first major school of economic thought, emerging in the 18th and 19th centuries. These economists believed that free markets — left largely untouched by governments — would naturally lead to efficient outcomes. Their theories were built around the idea that individuals, acting in their own self-interest, unintentionally promote the good of society as a whole.

KEY FIGURES

1. Adam Smith: Known as the father of economics, he introduced the idea of the invisible hand, suggesting that self-interested actions can lead to socially beneficial outcomes.

2. David Ricardo: Developed the theory of comparative advantage, showing how trade can benefit all nations, even when one is more efficient at producing everything.

3. Thomas Malthus: Warned that population growth could outstrip food supply, leading to poverty and famine — an early example of linking economics to environmental constraints.

-

Markets are self-correcting: Unemployment and surpluses are temporary — wages and prices adjust.

-

Limited government: Governments should only provide defence, law enforcement, and basic infrastructure.

-

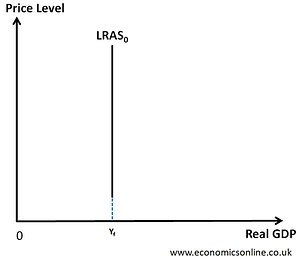

Long-run focus: Classical economists believed economies would always return to full employment in the long run.

🔎 A-level Link: These ideas underpin the free market diagrams and price mechanism topics, and appear in macro debates on whether governments should intervene during recessions.

Keynesian Economics

Keynesian economics emerged in the 1930s as a direct response to the Great Depression, when unemployment was high and classical ideas about market self-correction were failing. British economist John Maynard Keynes argued that in times of economic crisis, governments must take an active role in managing demand to avoid prolonged recessions.Keynes challenged the classical view that economies always return to full employment on their own. He believed that aggregate demand (AD) — the total demand for goods and services — was the key driver of economic activity. If demand falls, businesses cut output and jobs, leading to a downward spiral unless something intervenes.

🧠 A-level Link:

Keynesian theory explains much of the AD/AS model, fiscal policy, and multiplier effects in macroeconomics. It also forms the basis for debates about government spending during recessions (e.g. COVID-19 stimulus packages).

Key Ideas

-

Demand drives output: If people and businesses don’t spend, the economy contracts.

-

Government intervention: In a downturn, governments should increase spending or cut taxes to boost AD.

-

Multiplier effect: One person’s spending becomes another person’s income, so stimulus has a ripple effect.

-

Sticky wages and prices: Unlike classical theory, Keynes argued wages and prices don’t always adjust quickly, leading to persistent unemployment.

🔧 Fundamental Concepts

⚖️ Opportunity Cost

The cost of the next best alternative foregone. Every decision — from government spending to your weekend plans — involves a trade-off.Example: If a government spends £10 billion on defence, it can't spend that same money on healthcare.A-level link: Appears in PPC diagrams, resource allocation, and government policy evaluation.

📉 Supply and Demand

The foundation of market economics. Prices are determined where supply and demand meet — the equilibrium.

-

If demand increases, price rises.

-

If supply falls, shortages push prices up.

A-level link: Used constantly in market analysis, government intervention, and elasticity topics.

📊 Elasticity

Measures how responsive one variable is to a change in another.

Price Elasticity of Demand (PED): % change in QD / % change in price

Income Elasticity (YED), Cross Elasticity (XED), Price Elasticity of Supply (PES) also apply

A-level link: Crucial for analysing tax policies, subsidies, and price changes in different markets.

🏛️ Market Failure

When the free market doesn’t lead to an efficient or fair outcome.

Examples include:

-

Externalities (pollution, education)

-

Public goods (street lighting, defence)

-

Imperfect information

A-level link: Central to government intervention, evaluation of policies, and environmental economics.

🏗️ Government Intervention

When markets fail, governments may intervene through:

-

Taxes and subsidies

-

Regulation or price controls

-

Provision of goods and services

A-level link: Evaluate whether intervention corrects the failure — or causes unintended consequences.